Blog

2019 Market Facilitation Program: How they got there and how does it help

The United States Department of Agriculture’s (USDA’s) Office of the Chief Economist (OCE) released background information on August 23, 2019 on the methods the office used to calculate the damage caused to farmers and ranchers in the United States by retaliatory tariffs imposed by various countries–USDA’s Market Facilitation Program (MFP). In most cases, these tariffs were placed on agricultural products in response to tariffs imposed by the Trump administration in an attempt to drive trade negotiations. The most obvious example–and one with some of the largest impacts on the agricultural sector–have been tariffs against China.

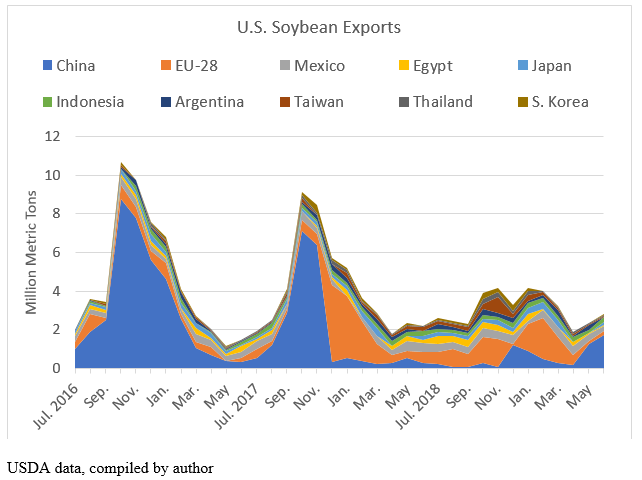

There is no question–soybean exports have been negatively affected over the last several years as China found other sources of supply. (See chart below.) The European Union, as well as Mexico and Taiwan, picked up some of the lost demand, but the sheer size of the Chinese market makes it hard to replace. And the monthly data makes it clear that it was like falling off of a cliff.

The OCE approach to calculating these damages was straightforward. What was the level of exports before imposition of the retaliatory tariffs? What was the level of exports after? What would the price effect of the loss of exports be? The first round of payments used the same approach. One main difference between the 2018 MFP payments and the 2019 payments just announced is that the 2018 payments compared exports between the 2018 and 2017 market years. This round, “USDA employed a longer time-series to estimate gross trade damages, by surveying trends in U.S. bilateral trade over a 10-year period (2009-2018).”[1]

Another significant change from last round of MFP payments is the coverage of “non-specialty crop” commodities. Last year, the crops used to calculate a county’s payment rate included cotton, corn, sorghum, soybeans and wheat. This year, the eligible list includes those crops plus rice, peanuts, lentils, peas alfalfa hay, dried beans and chickpeas. The main reason for expanding the list was to ensure the program itself would not drive planting decisions. If payments were made based on particular crop plantings, chances were a producer might make future planting decisions expecting a payment. Spreading the list to include a broader range of crops should mitigate that effect.

One can argue over the amount of lost exports or the price impact, but the methodology–the sector lost exports, that action impacted farmers’ price, the government writes a check to make up the difference–is a pretty straightforward approach to dealing with the symptoms.

What it does not do is deal with the underlying disease. And this is a disease that may affect the agricultural sector for years to come. The Chinese market is but one example where the agricultural sector had been working for years to establish a reputation as a reliable supplier, as a source that could be counted on for any quantity on any given day. China is now looking closely at Russia, Ukraine and other Black Sea countries as long-term sources of oilseeds and other feedstuffs. But, China is not the only market to be impacted. The administration has removed some of the tariffs applied to Mexico and Canada. Mexico has returned as a solid customer, but these actions have at least made Mexico think about alternative suppliers, as has Canada.

Once your customer–who has only looked to you in the past–starts to turn elsewhere, you have a problem. This is a problem that may take decades to overcome. The payments and the methodology used by OCE are very helpful in the middle of this market downturn, but there will still be market loss.

Robert Young is the former chief economist for the American Farm Bureau Federation. He has also served as chief economist of the U.S. Senate Committee on Agriculture. He holds a Ph.D. in agricultural economics from the University of Missouri.

[1] U.S. Department of Agriculture Office of the Chief Economist “Trade Damage Estimation for the 2019 Market Facilitation Program and Food Purchase and Distribution Program” Aug. 22, 2019